The academic paper titled “Does Labor Share of Economic Achievements Affect the Crossing of the Middle-income Trap”, written by Prof. Yuan Yiming and Dr. Xu Changjian and published in Journal of Shenzhen University (Humanities & Social Sciences), Issue 5, 2020, was reproduced by authoritative journals China University Academic Abstracts (one of China’s top three digests) (full text), Issue 9, 2020 and Academics, Issue 11, 2020.

Yuan Yiming, Deputy Director, Professor and PhD advisor of China Center for Special Economic Zone Research (CCSEZR)

Xu Changjian (corresponding author), PhD in Economics, Lecturer of Guangdong Polytechnic Normal University

Originally published in Journal of Shenzhen University (Humanities & Social Sciences)

Issue 5, 2020

Labor remuneration reflects how much workers share economic achievements, and determines their social and economic status. Facts around the world show that the labor share of economic achievements is an important factor affecting sustainable economic growth. The higher the labor income share, the greater impact it has on economic growth, and the faster economy grows. It takes less time for economies with a higher labor income share and continuous improvement to move from the upper-middle income stage to the high-income stage while it takes more time for countries or regions with low labor income share to make the transition. Countries or regions whose labor income share is less than 50% and showing a declining trend fail to achieve the transition from the upper-middle income stage to the high-income stage. Empirical data analysis further reveals that labor share of economic achievements is a major factor for economic growth. The higher the labor income share, the faster the GDP per capita grows, the less time it takes to move from the upper-middle income stage to the high-income stage, and the more favorable it is to achieve sustainable economic development. Apart from improving the worker’s enthusiasm, labor share of economic achievements can also promote the formation of economic growth capacity by influencing human capital investment.

Key Words

labor share; economic achievements; human capital; sustainable economic growth; middle-income trap; international comparison

I. Introduction

Economic achievements are distributed among workers, enterprises and government sectors, where workers receive labor remuneration, enterprises receive capital revenue (including consumption of fixed capital and operating surplus) and the government receive net product taxes. Labor remuneration reflects the labor share of economic achievement by the majority of workers and reflects the status of workers in social income distribution.

Since the establishment of socialist market economy in China, the income distribution structure has changed considerably, and the distribution pattern of national income among residents, government and enterprises comprises 3 stages. The first stage is characterized by a substantial increase in the proportion of labor income (1978-1996). The implementation of the basic state policy of “reform and opening up” and the strategy of “taking economic development as the central task” established in the Third Plenary Session of the 11th Central Committee of the CPC has stimulated the enthusiasm of all participating subjects in economic development. In 1987, a distribution system in which distribution according to work is dominant and a variety of modes of distribution coexist was established for the primary stage of socialism, which substantially increased the proportion of labor remuneration. From 1978 to 1996, the proportion of income received by residents rose from 49% to 67.2%, the income received by enterprises fell from 37.5% to 20% and government income fluctuated between 12.8% and 15%. The labor income share in this stage also rose from a low level at the beginning of the reform and opening up to a level of over 50%. The second stage is characterized by a declining proportion of labor remuneration (1996-2007). In this stage, the distribution system combining distribution according to work and distribution according to production factors was implemented, and the share of capital return and the share of government income increased. From 1996 to 2007, the share of income received by residents fell from 67.2% to 58%, the share of income received by enterprises rose from 20% to 26.9%, the share of income received by government sectors rose from 12.8% to 14.6%, and the labor income share fell from about 50% to 39.7%. The third stage is characterized by the stable and low proportion of labor remuneration (2007 to present). The improvement of the proportion of labor remuneration in the primary distribution and the establishment and improvement of the primary distribution system in which production factors such as labor, capital, technology and management participate in the distribution according to their contributions have led to small fluctuations around 60% in the proportion of income received by the residents, a small increase in the proportion shared by the government, and a small downward trend in the proportion of income received by the enterprises.

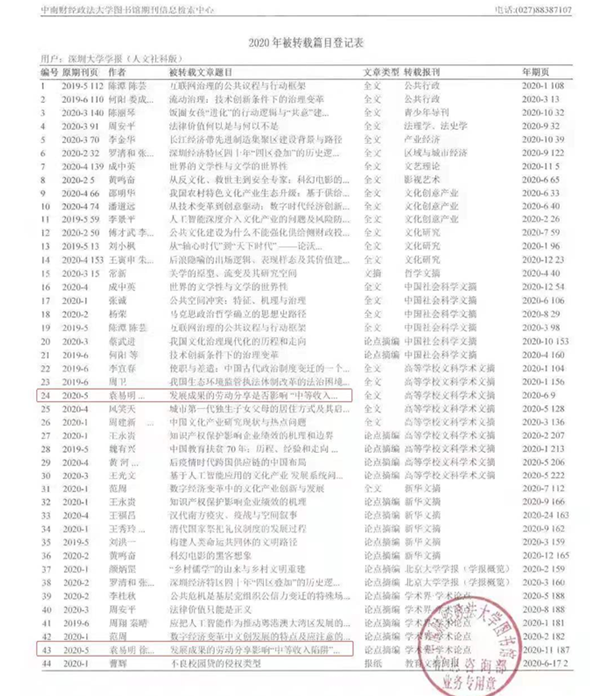

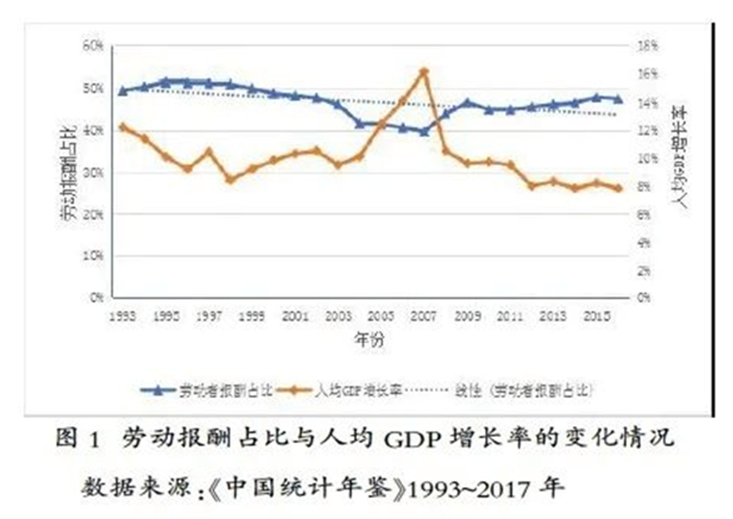

As shown in Figure 1, the proportion of labor remuneration, which is the main source of income for residents, fell from 53.4% of China's GDP in 1990 to 39.7% in 2007 and rebounded slightly in recent years to 47.5% in 2016. The growth rates of labor income share and GDP per capita also show periodic changes. In terms of time dimension, the growth rate of GDP per capita declined with the decline of labor income share from 1993 to 1998, while the growth rate of GDP per capita increased with the decline of the labor income share from 1998 to 2007, and the growth rate of GDP per capita was in a declining trend with the stabilization of the labor income share after 2007. In general, the labor income share in China has been declining in the past decades. Compared with the rest of the world over the same period, the proportion of labor remuneration in national income in China is not only much lower than that in developed countries, but also lower than the world average level [1].

In the process of economic development, primary distribution focuses on efficiency and redistribution focuses on fairness. Primary distribution according to factor contribution has become a consensus in the theoretical circles. However, the distribution according to factor contribution should be based on the premise of perfect market competition and no distortion of factor prices should exist. As a developing country, China's factor market is not yet perfect, and the allocation of land and capital is disturbed by non-market forces. The distortion of factor prices has been demonstrated by many researchers. In this case, factor prices are not a true reflection of their contribution, i.e., there is a mismatch between the income received by factor owners and the role they played in the economic process. Income higher than contribution creates a "distributional plunder" and income lower than contribution creates laziness which affects the basic driving force of economic growth.

The GDP per capita in China exceeded USD10,000 in 2019. According to the definition of the World Bank, China is at the stage of moving from upper-middle-income level to high-income level①. According to international experience, in the process of moving from middle-income level to high-income level, some economies have successfully become high-income countries, while some economies have experienced long-term growth hovering and failed to enter the high-income level stage, which is also known as falling into the "middle-income trap". Economies falling into the middle-income trap are marked by a slowdown in economic growth, a widening gap in social income distribution, a low share of residents' income in GDP, and a structure of distribution between labor and capital that favors capital. Thus, it is a question worthy of deep thinking and research whether labor share in the primary distribution will affect the crossing of the "middle-income trap" and the formation of sustainable economic growth in the process of economic development.

In the process of economic development, the relationship between growth and distribution is a major issue common to many countries or regions. Therefore, the development strategy choices of growth before distribution, distribution over growth, and distribution with growth have emerged successively. The “growth before distribution” model, which advocates prioritizing growth and ignoring income distribution, gets its theoretical basis from Kuznets and Lewis. Kuznets' inverted "U" curve theory suggests that income inequality automatically increases and then decreases with the increase of GDP per capita [2]. Lewis argued that capital accumulated in the hands of the minority is in favor of binary economic growth and structural change, and therefore income inequality is a necessary condition for growth [3]. The result of such distribution model is that capital prevails and workers are disadvantaged relative to capitalists and receive low incomes.

The “distribution over growth” model, which pays special attention to the equity of income distribution in the development process, focuses on the average welfare of society when capital accumulation is still low at the early stage of development, resulting in a lack of capital accumulation and inefficient economic growth. Few economies in the world adopt this model because the material basis that can be allocated is insufficient. The result of this model is an increased income earned by workers and a low income earned by capitalists, a lack of capital accumulation at the early stage of development which in turn affects the material basis that supports economic growth, and a sluggish growth.

The “growth with distribution” model balances equitable distribution and economic growth and combines economic growth and equitable distribution at the initial stage of capital accumulation. In the development process, the increase of capital accumulation improves the human capital level and promotes economic growth; along with sustained and stable economic growth, the equity of education is increased and the accessibility of public services and benefits such as healthcare, health and culture is enhanced. This model takes into account the workers' share of economic achievement at the early stage of development, so that a constructive interaction between economic growth and income distribution can be achieved and a balance between equity and efficiency can be realized.

The "middle-income trap" was first raised by the World Bank in 2007. The World Bank, through a study of East Asian economies, argued that in the process of crossing the middle-income stage, only a shift in economic development towards innovation and productive specialization, etc., can avoid falling into the middle-income trap. Ye Chusheng believes that a middle-income trap is a phenomenon in which the economic development of a country languishes after it has reached the middle-income stage due to problems such as disparity between the rich and the poor, environmental degradation and even social unrest [4]. Justin Yifu Lin found that, among more than two hundred developing economies in the world between 1950 and 2008, only South Korea and Taiwan, China changed from low-income to high-income economies; 13 economies changed from lower-middle-income to high-income economies, eight of which were European countries around Western Europe, which were not far behind the developed countries; the gap of per capita income between 28 economies and the United States has been narrowed by 10%, many of which were countries exporting oil and other resources; in addition, the gap of per capita income between another 18 economies and the United States was not narrowed but increased by more than 10% [5]. This indicates that the vast majority of developing countries are still stuck in the low-income or lower-middle income trap with slow income growth since World War II. Academics use the deceleration of economic development as an important basis for determining whether an income trap has emerged. The causes of middle-income trap have become an important branch of research on this issue. Existing studies have mainly explored the causes of the middle-income trap from the perspectives of system, population and economic structure, among which the income distribution gap has become an important factor for exploration by researchers. For example, Zhang Jichao and Zhang Xian et al. found that primary distribution plays a fundamental role in determining the redistribution, and labor income share is negatively correlated with the Gini coefficient of individual income distribution [6][7].

Labor income share is the proportion of remuneration received by labor factors in the total income. From a macro perspective, the labor income share reflects the degree of share of development achievement. Kaldor was the first to study the relationship between labor income share and economic growth. By investigation in some major developed countries, he proposed the "Kaldor Facts", stating that labor income share is stable and constant during economic growth [8]. But from subsequent studies by others, most countries do not meet the conclusion that labor income share is constant during economic growth. For example, Harrison found that labor income share declined in poor countries and increased in rich countries over the 30-year period, based on the Cross-country Panel Data from 1960 to 1997 [9].

Chinese scholars have also not reached a consistent conclusion about the relationship between labor income share and economic growth. One view is that an increase in labor income share is good for economic growth. By using empirical analysis on the time-series data since China's reform and opening up, Liu Dun et al. found that improvement of labor income share can promote economic growth and achieve equity and efficiency [10]. Zhou Minghai et al. argued that changes in the pattern of national income distribution are closely related to the unbalanced growth of factors in the process of economic growth [11]. Based on the perspective of biased technological progress, Zheng Meng and Yang Xianming proposed the hypothesis that the elasticity of substitution between labor and capital affects labor income share and empirically tested it based on provincial panel data in China from 2000 to 2012. Study results show that despite the significant growth effect of factor substitution, the increase in the elasticity of substitution between labor and capital makes technological progress increasingly biased toward capital, which in turn significantly reduces the labor income share and further worsens the pattern of factor income distribution, ultimately creating resistance to China's entry into the ranks of high-income countries [12].

Another view points out that labor income share has a U-shaped relationship with economic growth. Li Daokui et al. found that the change of labor income share in the process of economic development presents a U-shaped pattern, i.e., the labor income share first declines and then rises. In PPP terms in 2000, GDP per capita of USD 6, 000 was the inflection point of the change of the labor income share [1]. After an empirical test of the Cross-country Panel Data on 52 countries and regions, Li Qi found that the U-shaped inflection point of labor share was around 6728 international dollars (at constant price in 2005). A comparative analysis of the cross-country data sample with Chinese data shows that labor income share in China has a clear sign from declining to increase, but the shape of the "U" curve and the position of the inflection point will be influenced by the technological progress in agriculture and the employment status of self-employed people and production technology [13]. Wang Xiaolu and Fan Gang's study did not find a Kuznets' inverted U curve relationship between income distribution and economic growth in China [14].

Although there is no consensus among scholars on the changes in the proportion of labor remuneration in the process of economic growth, there is a consensus that a relationship exists between the proportion of labor remuneration in the primary distribution and economic growth. As an important part of the primary income distribution, the proportion of labor remuneration in the total national income is directly related to the share of development achievement by the majority of workers and the incentives for them. At present, China is in the risk period of "middle-income trap", and the share of development achievement determines whether China can successfully cross the middle-income stage. In this paper, we will try to examine the relationship between labor income share and economic growth from the empirical perspective of international development, and provide fundamental research achievements for China to successfully enter the high-income stage and achieve sustained economic growth.

III. International Comparison of the Relationship between Labor Share and Economic Growth

(i) The Practice of Developed Countries in Europe and America, represented by the U.S. and the U.K.

In the process of industrialization, European and American countries were influenced by the mainstream economic theory of prioritizing economic growth and emphasized growth over distribution for a long time.

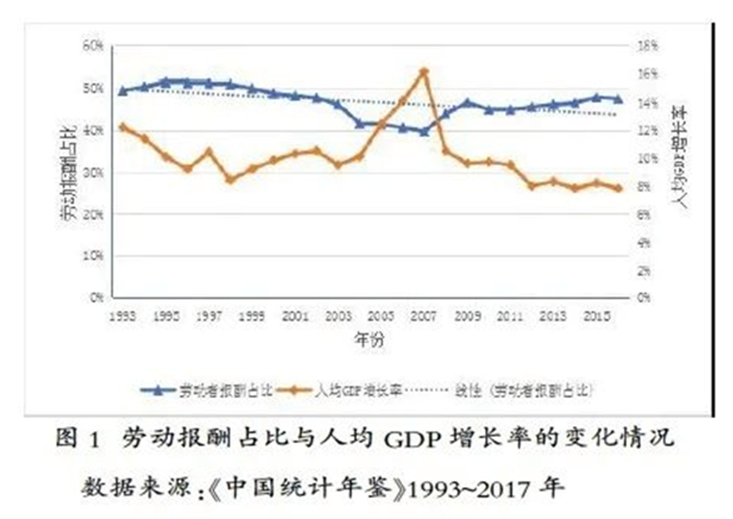

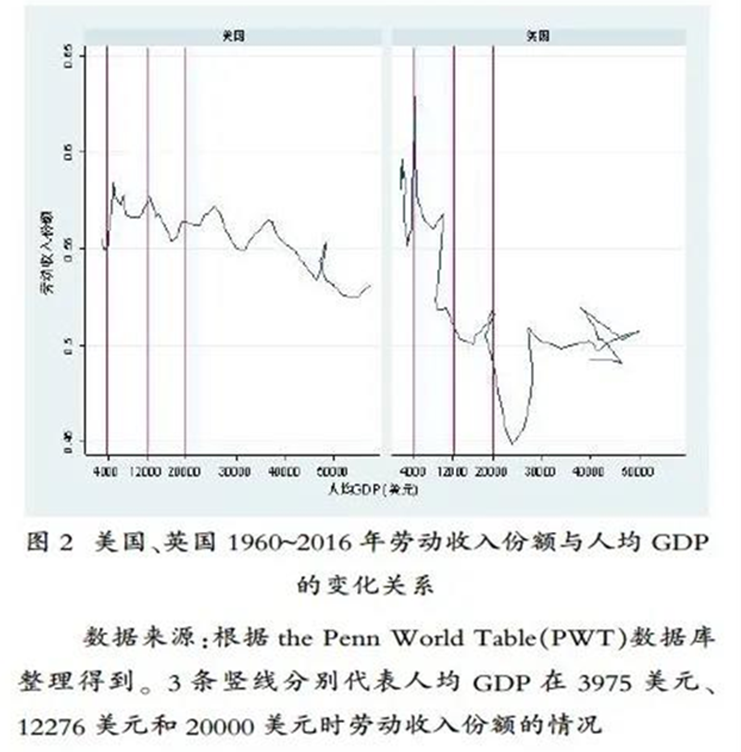

The United States experienced a huge gap between the rich and the poor in the 1960s and 1970s. To narrow the gap, the United States adopted joint ownership of share to allow more resources and wealth to be jointly owned by the people and encourage employees to hold property rights. The U.S. GDP per capita reached USD4,146 in 1966 and USD10,587 in 1978, and the labor income share rose from 55.6% in 1966 to 56.6% in 1978. The labor income share stayed around 55% when GDP per capita was between USD12,276 and USD20,000 (Figure 2). The level of human capital in the United States has also been growing. The number of years of education of workers increased by 1.38 years between 1915 and 1940, 1.52 years between 1940 and 1960, and 1.93 years between 1960 and 1980. The labor productivity in the United States showed constant growth during this period [15]. After the 1980s and 1990s, labor income share in the U.S. slightly declined, and the growth rate of GDP per capita also declined compared with that before the 1980s.

U.K. was the first country to start industrialization. To narrow the income gap and share the fruits of labor, the U.K. government adopted an active employment policy and a sound social security policy. U.K. enacted the Poor Law in 1601, and established a series of social security systems in the 19th century, one of which was the labor income distribution system. U.K. had a high labor cost and a large labor income share in the income distribution, which was dominant in the income distribution pattern. In contrast, the proportion of capital factors was declining. The labor income share in the UK remained at about 60% between 1800 and 1880. In 1960, GDP per capita was USD1,380 and the labor income share was 58.1%; in 1975, GDP per capita reached USD4,299 and the labor income share rose to 62.9%. Similar to the U.S., labor income share in the U.K. was also declining after the 1980s, with the GDP per capita reached USD10,032 in 1980 and the labor income share declined from 62.9% in 1975 to 56.8%. Labor income share was declining but above 50% when GDP per capita was between USD12,276 and USD20,000 (Figure 2).

In general, the U.S. saw a small increase in labor income share during the development of GDP per capita from USD3,975 to USD12,276, and the U.K. saw a small fluctuation in labor income share during the development of GDP per capita from USD3,975 to USD12,276 due to the high labor income share in the early years, but that in both countries remained at around 55%. Since the 1980s and 1990s, there has been a trend for distribution to favor capital with the economic globalization and globalization of capital. It took 15 years for the U.S. and 13 years for the U.K. to cross from the upper-middle-income stage to the high-income stage. The labor income share generally tended to be stable between 50% and 60% as GDP per capita increased from USD12,276 to USD20,000, and was at a high level during the transition from the upper-middle-income stage to the high-income stage. In the process of development, the U.S. and the U.K. etc. adopted measures that favored an increase in labor income share and maintained a sustained growth in GDP per capita. Developed countries in Europe and America adopted a growth-first strategy in the early stages of industrialization. With the development of industrialization, the income gap widened and economic growth slowed down, and many countries realized the importance of the income distribution gap and adopted a series of measures to raise workers' income and social security levels.

(ii) Successful Strategies in East Asian Countries or Regions

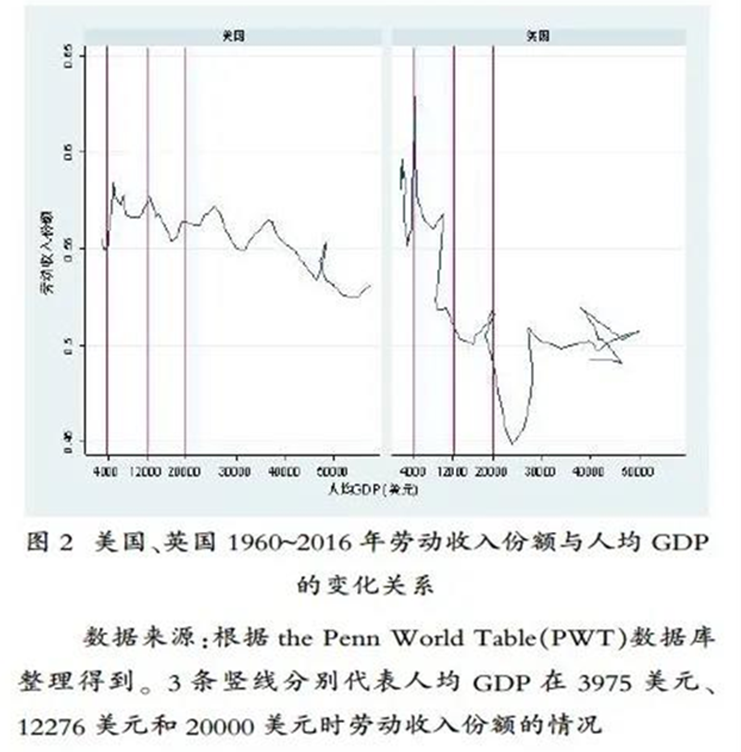

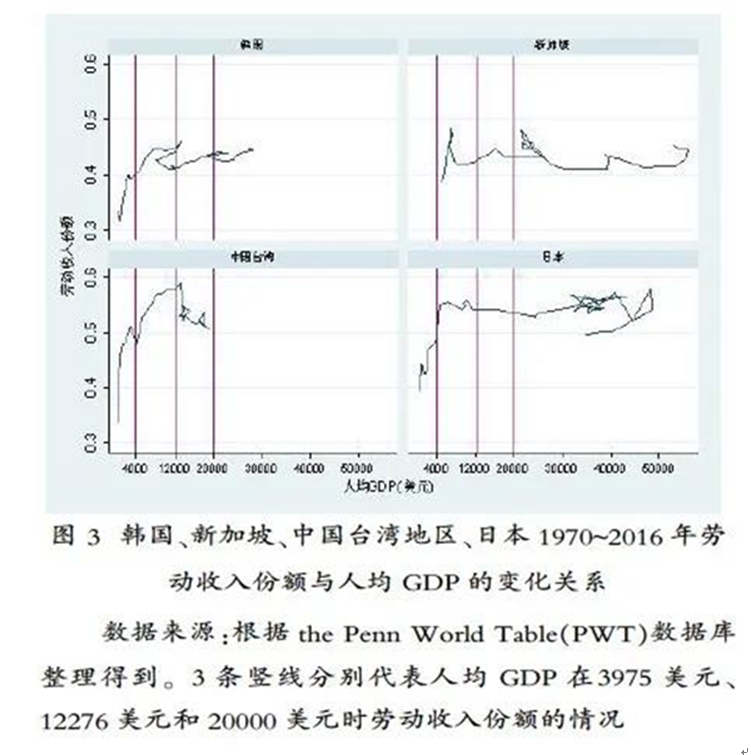

In South Korea, GDP per capita reached USD4,813 in 1988 and USD10,275 in 1994, and labor income share increased from 41% in 1988 to 44% in 1994 and remained between 40% and 50% when GDP per capita was between USD12,276 and USD20,000 (Figure 3).

South Korea has focused on equitable distribution in the process of economic development and has promoted employment and income growth for the people through a series of policies such as investment in human capital and preferential development of labor-intensive industries. In the initial stage of development, South Korea developed export-oriented policies for the labor-intensive light textile industry and strongly supported the development of small and medium-sized enterprises. Due to the impact of cheap products from China, South Korea began to encourage the preferential development and export of capital-intensive industries such as heavy chemicals after 1973. Under the principle of "shared development", the government raised the wages of workers in all walks of life so that members of society can share the development achievement. Since the 1980s, Korea has implemented the policy of "rationalization of industry" focusing on technology development and efficiency improvement, and has strengthened the market mechanism. The government paid attention to the cultivation of human capital and improved the education level of the overall workers through national education. After a long period of human resource development, the level of education of the Korean workers has increased significantly, greatly improving the labor skills, technical level and the quality of workers and changing the labor pattern. Among the employed workers, about 20% of them have a junior middle school education or less and 40% of them have a university education or above. The improvement in the overall level of human capital has contributed to the increase of residents' income in the primary income distribution. In general, government-leading strategy and economic growth with equitable distribution are two important features of the economic boom in South Korea.

In Singapore, GDP per capita reached USD4,000 in the 1980s and USD10,000 in the 1990s, and labor income share rose from 40% to 59% in 1995 and fluctuated between 50% and 60% when GDP per capita was between USD12,276 and USD20,000 (Figure 3). Singapore established a government-led, collective bargaining mechanism with a steady rise in wages and earnings of workers in the process of economic development to ensure labor income distribution during development.

In Taiwan, China, GDP per capita reached USD4,000 in the 1980s and USD10,000 in the 1990s, and labor income share also increased from 40% to 59% in 1995 and fluctuated between 50% and 60% when GDP per capita was between USD12,276 and USD20,000 (Figure 3). In the development process, the government of Taiwan, China has always taken “equality of wealth" as the primary goal of economic and social development, and taken economic growth, price stability and equal income distribution as the goals to be achieved simultaneously. All of these were implemented in all policies. Through land reform at the early stage, prosperous development of small and medium-sized enterprises, and sound social security measures, Taiwan, China has ensured a fair income distribution in the process of rapid economic growth, and has vigorously developed labor-intensive industries to properly solve the employment problems and keep the unemployment rate at a low level. During the economic boom stage, Taiwan, China paid special attention to the development of education. From the 1950s to the 1960s, huge amounts of money were invested in education, and the spending on education, science, and culture consistently accounted for more than 13% of administrative budgets at all levels. A low tuition fee system and a unified entrance examination system were implemented. In addition, tax policies (a substantial consumption tax on luxury goods), public spending policies, and social security policies were also implemented.

In Japan, GDP per capita rose from USD4,281 in 1974 to USD10,212 in 1981, labor income share rose from 52.2% in 1974 to 54.9% in 1981 and was stable at about 55% when GDP per capita was between USD12,276 and USD20,000, and the proportion of labor remuneration in GDP increased from 40% in 1960 to 55% in 1975 (Figure 3). After World War II, the development of production in Japan grew rapidly, but low national income caused various conflicts. Therefore, Japan took a series of measures, including dismantling the financial cliques; carrying out land reform, so that the proportion of the area of land leased by landlords to the arable area decreased from 46.2% in 1941 to 13.1% in 1949, and the proportion of self-owned land increased to 86.9%; implementing labor reform, enacting the Labor Union Law and the Regulation Law of Labor Relations, etc., to give legalized status to trade union organizations and strengthen the rights of workers in terms of working conditions, collective bargaining, and labor disputes. These measures changed the disparity in income distribution between the high-income class such as large capitalists and landowners and the peasants and workers. New business operators did not own or owned little shares and relied on salary income; a labor-capital relationship characterized by enterprise unions and long-term employment, etc. was formed. Meanwhile, measures such as combating monopolies, encouraging competition, and reducing monopoly profits of large enterprises increased the share of employees’ national income in the primary distribution. In 1960, Japan formulated the "Income Doubling Program", so that the resident's income grew rapidly under the government's strong and continuous promotion of the program. Meanwhile, continuous accumulation of human capital was formed. In the process of leading economic development, the government closely integrated income distribution with social security policies to promote economic development as its main task, and the income distribution gap in the field of primary distribution was controlled.

Through a comparative analysis of developed countries in Europe and America, emerging economies that have successfully crossed the lower-middle-income stage such as Singapore, and other countries that have been in a developing state for a long time, we can get the following basic conclusions: countries or regions with a low labor income share in the development process took longer time to cross from the upper middle-income stage to the high-income stage; economies with a declining labor income share below 50% failed to leap from the lower-middle-income level to the high-income stage; economies with a high and consistently rising labor income share successfully reached the high-income development stage and taken a relatively short time to move from the upper-middle-income to the high-income stage with sustained economic growth.

Compared with other countries around the world, it seems that both labor remuneration and the proportion of residents' income to GDP in China are significantly lower when the GDP per capita is between USD3,975 and USD12,276. The proportion of labor remuneration to GDP in developed countries in Europe and America is generally around 55%, and the proportion of residents' income to GDP is generally around 65%. Compared with the newly developed economies such as Singapore, South Korea and Taiwan China which have successfully crossed the "middle-income trap", the proportion of labor remuneration to GDP in China mainland is higher than that in South Korea and Singapore but lower than that in Taiwan, China. The proportion of labor remuneration to GDP in these economies is on an upward trend in the process of crossing the middle-income stage, without the sustained declining problem as seen in China mainland. In terms of specific development stages, the proportion of labor remuneration in emerging developed economies in Asian had a relatively low period accompanied by a few years of declining, but there was no period of sustained declining during the period of industrial acceleration (especially heavy industry). For example, in Japan and South Korea, there were also years when the proportion of labor remuneration was about 30%, but a sustained declining trend did not occur during the stages of developing their heavy industries. Regardless of in developed countries in Europe and America, or in industrialized countries after World War II, the proportion of labor remuneration in the primary distribution has always been the highest among all factors of income, and tends to rise during industrialization and stabilize after the completion of industrialization, but all are higher than 50%.

IV. Empirical Test for the Relationship Between Labor Share and Economic Growth

(i) Method Selection and Model Setting

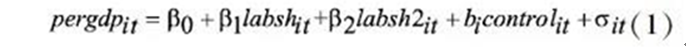

According to Li Daokui and Xu Changjian’s study [1][16], there is a U-shaped relationship between GDP per capita and labor income share. To explore the relationship between labor share and economic growth, the following econometric analysis model was developed:

In equation (1),

i refers to a country or region,

t refers to a year,

pergdp refers to GDP per capita (USD/person);

labsh refers to labor income share,

labsh2 refers to squared term of the labor income share;

control refers to control variables, β0 is a constant, β1, β2, and

bi are coefficients of the variables, which refer to disturbance. Where, the control variables include the share of gross capital formation to GDP (csh_i), degree of dependence on foreign trade (dft), household consumer price level (pl_c), the proportion of employed people to the total population (rp), and human capital index (hc) etc.

According to the study of Galor et al., labor remuneration will affect human capital accumulation of workers by influencing intertemporal consumption decisions, which in turn affects economic growth. There may be a lag in the impact of labor remuneration on economic growth [17]. Therefore, the following model was established:

Human capital in model (2) is prone to endogenous problems, and model (2) is a dynamic panel model. As a commonly used method for estimating dynamic panel data models, the GMM estimation method does not require accurate distribution information of the disturbance, and the disturbance may have serial correlation and heteroscedasticity. Therefore, the estimated results will be more robust and reliable. This is why the GMM method is chosen for model estimation in this paper.

(ii) Definition of Indicators and Data Source

There are two bases for selecting the samples of those who crossed the middle-income trap and those who failed. The first basis is that, according to the analysis in Part II of this paper, existing studies have reached relatively consistent conclusions on whether some countries or regions have crossed the "middle-income trap", which is an important reference basis for sample partitioning in this paper. The second basis is that, according to the analysis of international facts in Part III of this paper, GDP per capita in emerging market countries and regions such as Japan, South Korea, Singapore and Taiwan, China continued to grow in the development process. There was a declining trend of income gap in the upper-middle income stage with GDP per capita from USD3,975 to USD12,276 as classified by the World Bank, and it took a shorter time staying in this stage. It can be regarded as successfully crossing the "middle-income trap” when the GDP per capita of these countries or regions continued to grow and successfully exceeded USD12,276 (indicating that they have become high-income countries or regions) and showed a continuous growth trend. But in Brazil, Mexico and other countries, GDP per capita reached the upper middle-income level early but never exceeded USD12,276, even showing a declining trend, and the income distribution gap has been growing, which can be considered as caught in the "middle-income trap".

According to Zhang Jianhua, Cheng Wen, Lu Shanyong and Ye Ying et al., Japan, Singapore, South Korea and Taiwan, China are typical representatives of those who have successfully crossed the middle-income trap, while Latin America and some Asian countries are typical representatives of those who have been caught in the middle-income trap. These major Latin American economies include Mexico, Brazil and Argentina, and Southeast Asian countries include Malaysia, Thailand, the Philippines and Vietnam [18][19]. The conclusion of these researchers is consistent with the conclusion reached in Part III of this paper. Therefore, five economies, including South Korea, Japan, Singapore, Taiwan, China and Hong Kong, China, are selected as samples that have successfully crossed the "middle-income trap". Most of the low-income or middle-income economies, especially those in Southeast Asia and Latin America, failed to cross the "middle-income trap". Brazil, Mexico, Argentina, Malaysia, Philippines, Thailand, Vietnam, Cambodia, Indonesia, and Myanmar are selected as the sample of economies that failed to successfully cross the "middle-income trap" to examine the relationship between labor share and economic growth. To maintain data consistency, data from the Penn World Table (PWT) database were also used for the empirical analysis.

GDP per capita (pergdp) was selected as the explained variable to measure economic growth, which can be calculated using GDP divided by the population. Its natural logarithm was used for the empirical analysis. Labor income share (labsh) was selected as the explanatory variable, which represents the degree of labor share of economic achievements. The proportion of labor income of self-employed and self-hired to GDP was obtained by separately calculating the capital income and labor income of the self-employed and obtaining the sum according to the study of Gollin [20]. The human capital index (hc), measured by the human capital index per capita of average years of education, was calculated by the returns from primary school, middle school and university education assumed by Barro et al. [21] and Caselli et al. [22]. Its natural logarithm was used for the empirical analysis. Other control variables include the share of gross capital formation in GDP (csh_i); degree of dependence on foreign trade (dft), which is the sum of the share of goods imports in GDP and the share of goods exports in GDP; household consumer price level (pl_c), and the proportion of employed people to the total population (rp). The statistical description of the variables is shown in Table 1.

(iii) Empirical Results Analysis

To analyze the influence of labor share of economic development achievements on the ability of sustainable economic growth, we classified the samples into a group that has successfully crossed the “middle-income trap” and a group that failed to cross the “middle-income trap” in this paper. GMM method was used in this paper for empirical analysis. The results are as shown in Table 2.

In the all samples group, the influence coefficient of the labor income share on the GDP per capita is 0.673, which is significantly positive at the 1% level. But it is not significant in the group that has successfully crossed the “middle-income trap” and the group that failed to cross the “middle-income trap”. And there is no U-curve relationship between labor income share and GDP per capita. The influence coefficient of the lagged term of the labor income share on the economic growth is significantly positive in the all samples group and the group that has successfully crossed the “middle-income trap”; it is negative but not significant in the group that failed to cross the “middle-income trap”. This means that the increase of the labor income share is beneficial to the increase of the GDP per capita. And the influence of labor income share on the economic growth lags behind, because the labor income share is the main source of income of the worker, the increase of the worker’s income requires some time to be turned into the human capital investment.

Regardless of whether in the all samples group, the group that has successfully crossed the “middle-income trap” or the group that failed to cross the “middle-income trap”, the influence coefficient of the human capital on the economic growth is significantly positive. The influence coefficients are 1.331, 0.209, 2.061 respectively, among which the influence coefficient of the group that failed to cross the “middle-income trap” is far bigger than others. It means the improvement of the human capital level has more encouragement for the economic growth in the group that failed to cross the “middle-income trap”. The influence coefficients of the cross term of the labor income share and the human capital on the economic growth in the all samples group, the group that has successfully crossed the “middle-income trap” and the group that failed to cross the “middle-income trap” are 0.071, 0.161, 0.483 respectively, and they are all significantly positive. It means the increase of the labor income share is beneficial to the encouragement of the human capital for the economic growth, and the influence is bigger in the group that failed to cross the “middle-income trap”.

The above analyses indicate that the labor share of the economic development results is a key factor influencing the economic growth. The higher the labor income share, the bigger the influence on economic growth. The faster the speed of the economic growth, the shorter the time for moving from the middle-income stage to the high-income stage, and it is more beneficial for the economy to cross the “middle-income trap” and move to the high-income stage. The human capital estimated by education can significantly boost economic growth. Compared with the all samples group, the effect of the human capital is more significant in the group that has successfully crossed the “middle-income trap” and the group that failed to cross the “middle-income trap”. The increase of the labor income share is beneficial for the human capital to boost economic growth. And it becomes more influential in the group that failed to cross the “middle-income trap”. For the countries or regions that failed to cross the “middle-income trap”, the boost of the increase of the labor income share and the improvement of the human capital can have a double superimposed effect on the economic growth.

V. Conclusion and Insights

Through the comparative study of the developed countries represented by the United States and the United Kingdom, economies that have successfully crossed the “middle-income trap”, such as Singapore, South Korea, and Taiwan, China, and Latin American countries which are caught in the “middle-income trap”, such as Brazil, Mexico, the labor share influences a country or a region moving from the lower-middle-income stage to the high-income stage and also influences the sustainable growth of the GDP per capita afterward. The labor share influences the length of time for a country or a region moving from the upper-middle-income stage to the high-income stage. In the country or the region with a lower labor income share, the time for moving from the upper-middle-income stage to the high-income stage is longer; if the labor income share of an economy is lower than 50% and it is in a declining trend, the economy cannot move to the high-income stage; on the contrary, if the labor income share of a country or a region is high and keeps climbing, the time for moving from the upper-middle-income stage to the high-income stage is relatively shorter, which means the country or the region has successfully moved to the high-income stage and achieved the sustainable growth of the GDP per capita.

Furthermore, with the data of the Penn World Table (PWT) database in 1950-2014, through the empirical analysis on 5 economies (South Korea, Japan, Singapore, Taiwan, China and Hong Kong, China) which have successfully crossed the “middle-income trap” and 35 economies (including Brazil, Mexico, Argentina, Malaysia, the Philippines and Thailand) which failed to cross the “middle-income trap”, the labor share of the economic development results is a key factor influencing the economic growth. And the higher the labor income share, the faster the speed of the GDP per capita grows. If the time for moving from the middle-income stage to the high-income stage is shorter, it will be more beneficial for the economy to cross the “middle-income trap”. Through the empirical analysis, the human capital estimated by education can significantly boost economic growth. And the effect is more significant in the group that has successfully crossed the “middle-income trap” and the group that failed to cross the “middle-income trap”.

Human capital includes the accumulation of knowledge and skill gained by the worker through the investment in education, training, practical experience, migration and health care. The income level of the worker will influence the human capital investment [23] [24]; therefore, it will influence the improvement of the quality of the labor force. The endogenous growth theory proves that human capital is a key factor influencing economic growth. The influence mainly focuses on 3 aspects: (1) The effect of education on boosting the economic growth is bigger than the effect of physical capital; (2) The increase of the human capital is beneficial for innovation and improving the production efficiency; and (3) The output efficiency of the human capital is higher than other production factors, which has an important influence on the total factor productivity. The labor remuneration in the primary distribution is the main source of the resident’s income. It will influence the human capital investment of the worker and then it will further influence the economic growth. In terms of the facts of the international community development, the human capital level of the developed countries in Europe and America in the middle-income stage is higher. As the economy grows and the increasing speed of the labor income share slows down, the human capital level keeps improving but the speed is relatively slow; the countries or the regions which successfully crossed the “middle-income trap” have a relatively low primary human capital level. As the economy develops fast, the labor income share increases fast and the human capital level improves sharply to be close to the developed countries in Europe and America; the labor income share of some Latin American and Southeast Asian countries which failed to cross the “middle-income trap” increases during the process of moving from the lower-middle-income stage to the high-income stage. The human capital level is relatively low, it improves but it is still far lower than it in the developed countries in Europe and America and economies that have crossed the “middle-income trap”. For the countries or regions that failed to cross the “middle-income trap”, the boost of the increase of the labor income share can improve the boost of the human capital to the economic growth.

In this paper, we found the following insights:

1. It is urgent to deepen the reform of income distribution and build an income distribution system that is suitable for the current development stage of China. The labor share influences the ability and the time for crossing the development stage, especially the time for moving from the upper-middle-income stage to the high-income stage. The GDP per capita in China in 2019 exceeded USD10,000 for the first time, and it is in the upper-middle-income stage classified by the World Bank. According to the development history of major countries in the world, the rising trend of the proportion of labor remuneration should be kept to ensure moving from the upper-middle-income stage to the stage that GDP per capita is over USD 12,776 and keeps a sustainable growth; the labor remuneration share should be kept in the relatively high level and become the development factor of the highest proportion of the income sharing among all factors in the development stage of GDP per capita from USD 10,000-20,000. During the process of increasing the proportion of labor remuneration in the primary distribution, the government should give consideration to the policy formulation and build the distribution system that is beneficial to workers; the government should try its best to increase the farmers’ income during the rural revitalization and narrow the income gap with urban residents.

2. The labor remuneration should be increased, the incentive effect of income distribution on innovation should be significantly strengthened, and the driving force for the development of China in the new era should be raised. The main body of innovation is thousands of workers. The interest distribution and the material incentive for them will directly affect the innovation enthusiasm of the entire society, and then affect the time for high-quality development of the economy and ability of the sustainable development. So the policy based on being beneficial for the increase of workers’ income should be formulated to increase the workers’ income through multiple approaches. At the same time, the social security system for solving workers’ worries should be accompanied. During the process of moving from the middle-income stage to the high-income stage, the government should work hard to solve the problems of the income and the increase of wage of low-end workers in the small and medium-sized enterprises; it should build the wage growth mechanism and guarantee mechanism for migrant rural workers; guarantee the income level of the retired employees of enterprises; improve the proportion and the growth speed of the labor remuneration of workers with low education level, and achieve the common sharing of the development result in the general public. Then there will be a synergy of the development of the entire society to promote the sustainable growth of the high-quality economy of China and make China move to the developed stage successfully.

3. The education level of massive workers should be improved. On the one hand, the increase of the labor income share can promote the human capital investment of workers and improve the human capital level. On the other hand, the government should also increase the investment in education, especially in rural areas. It should intensify the training for workers, attach importance to the role of vocational education, improve the cultural quality and the professional skill of workers; increase supplying the groups, such as the rural surplus workers and the laid-off urban workers with the opportunities of education and training; increase the educational appropriations for massive rural areas, especially impoverished areas, and improve the education quality in rural areas.

Note:

{1} According to the World Bank’s definition of the countries with different income, the countries with Gross National Income per capita (“GNI per capita”) under USD 1,005 are low-income countries; the countries with GNI per capita between USD 1,005-12,276 are middle-income countries; the countries with GNI per capita above USD 12,276 are high-income countries; and the middle-income countries are classified into lower-middle-income countries and upper-middle-income countries with the line of USD 3,975.

[References]

[1] Li Daokui, Liu Linlin, Wang Hongling. Changes in the Labor Share of GDP: A U-shaped Curve [J]. Economic Research Journal, 2009, (1): 70--82.

[2] Kuznets,S. Economic growth and income inequality [J]. American Economic Review,1955,45 (1): 1--28.

[3] W.Arthur Lewis. Economic development with unlimited and limited supplies of labour [J].The Manchester School,1954, 22 (2): 139--191.

[4] Ye Chusheng. The Development Problem in the Middle-Income Stage and the Innovation of Development Economics: An Exploration of Theoretical Constructions Based on Contemporary China’s Economic Practices [J]. Economic Research Journal, 2019, (8): 167--182.

[5] Justin Lin Yifu. New Structural Economics [M]. Beijing: Peking University Press, 2015. 87--89.

[6] Zhang Jichao. Analysis on the Influence of Labor Income Share on Gini Coefficient of Personal Income Distribution [J]. Statistics & Decision, 2017, (21): 78--82.

[7] Zhang Xian, Meng Changyu. Empirical Analysis of the Relationship Between Function and Scale Income Distribution: the Perspective of Marxist Economics [J]. Social Science Front, 2017, (6): 55--64.

[8] Kaldor, N. A Model of Economic Growth [J]. The Economic Journal, 1957, 67 (268): 591--624.

[9] Harrison, A.E. Has Globalization Eroded Labor’s Share? Some Cross-Country Evidence [R]. UC Berkeley and NBER Working Paper, 2002.

[10] Liu Dun, Shi Zulin, Yuan Lunqu. Profit-led or Wage-led? A Theoretical Inquiry and Empirical Research in the Impact of Labor Share on Economic Growth [J]. Nankai Economic Studies, 2014, (2): 3--29.

[11] Zhou Minghai, Xiao Wen, Yao Xianguo. China’s Unbalanced Economic Growth and National Income Distribution [J]. China Industrial Economics, 2010, (6): 35--45.

[12] Zheng Meng, Yang Xianming. Research on the Effect of the Factor Substitution on the Income Distribution Under the Growth Mode: An Empirical Analysis Based on the Inter-provincial Panel Data of China [J]. Nankai Economic Studies, 2017, (2): 55--75.

[13] Li Qi. The U-shaped Curve of the Changes in the Labor Share During the Economic Development: The Theory and the Empirical Test Based on the Multinational Panel Data [J]. Forum of World Economics & Politics, 2016, (6): 104--118.

[14] Wang Xiaolu, Fan Gang. Analysis on the Trend of the Income Inequality in China and the Influential Factors [J]. Economic Research Journal, 2005, (10): 24--36.

[15] Zhang Bin, Sang Baichuan. Contradiction Between U. S. Human Capital Structure and Reindustrialization Demand [J]. Research on Economics and Management, 2015, (5): 82--88.

[16] Xu Changjian, Yuan Yiming. The Structure of Factor Income Distribution, Residents’ Consumption and Economic Growth [J]. Economic Survey, 2018, (6): 121--126.

[17] Galor, O. , J. Zeira. Income Distribution and Macroeconomics [J]. Review of Economic Studies, 1993, 60 (1): 35--52.

[18] Cheng Wen, Zhang Jianhua. Income Level, Income Gap and Independent Innovation: The Formation and Escaping of the Middle-Income Trap [J]. Economic Research Journal, 2018, (4): 47--62.

[19] Lu Shanyong, Ye Ying. Middle Income Trap, Comparative Advantage Trap and Comprehensive Advantage Strategy [J]. Economist, 2019, (7): 15--22.

[20] Gollin, D. Getting Income Shares Right [J]. Journal of Political Economy, 2002, 110 (2): 458--474.

[21] Barro, R., Lee, J. A New Data Set of Educational Attainment in the World, 1950-2010 [J]. Journal of Development Economics, 2013, 104: 184--198.

[22] Caselli, F., Wilson, D. J. Importing Technology [J]. Journal of Monetary Economics, 2004, 51 (1): 1--32.

[23] Zhang Anchi, Fan Shide. Labor Migration,Family Income and Rural Human Capital Investment: An Empirical Research Based on the Micro-Data of CFPS [J]. Modern Economic Research, 2018, (3): 19--26.

[24] Luo Feng, Huang Li. The Analysis of the Factors Affecting the Income Mobility of Rural Households in China: 1989--2009 [J]. Journal of Agrotechnical Economics, 2013, (8): 72--81.